ITEM D7 – INTEREST DEDUCTIONS

A taxpayer can claim a deduction against assessable interest income if they are able to show that they incurred fees, taxes or other

expenses in earning that income.

If the taxpayer is not the sole holder of the bank account, they can only claim their share of expenses relating to the investment (e.g. joint

bank accounts).

Account-keeping fees can be claimed as a deduction only when the account is held for investment purposes, for example, a cash

management account. If an account is maintained for both private and income producing purposes, account-keeping fees must be

apportioned on some reasonable basis between each purpose.

ITEM D8 – DIVIDEND DEDUCTIONS

Deductions for loan interest expenses and borrowing costs may be claimed if incurred on money borrowed to purchase shares and other

related investments from which assessable dividend income is derived (or it is reasonable to expect that it will be derived) IT 2606.

A taxpayer may borrow money to purchase shares where there is a reasonable expectation of a dividend, but no dividend income was

earned during the tax year. This could be due to the fact that the shares were purchased after the final dividend was paid for the year, or that

the shares did not perform as well as expected. In these circumstances, the interest and borrowing costs may still be deductible.

Where money is borrowed to purchase shares for the purpose of selling and making a capital gain, the interest and borrowing costs will not

be deductible under s 8-1, so will not be claimed at Item D8. It will be included in the cost base for capital gains purposes when the shares

are sold.

Where they are deductible, borrowing expenses over $100 are claimed over the lesser of 5 years or the length of the loan (if the borrowing

expenses are under $100 they can be claimed outright). Borrowing expenses will be discussed further in a later module.

If money borrowed is used for both private and income producing purposes, then the deductions for interest, fees and charges must be apportioned on some reasonable basis between each purpose. Only the interest, fees and charges incurred for an income producing purpose

are deductible.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

62

Management fees, retainers and advice

Deductions may also be claimed for:

• ongoing management fees

• retainers

• amounts paid for advice relating to changes in the mix of investment

Claims cannot be made for:

• expenses incurred in deriving exempt income

• a fee charged by an investment advisor for drawing up an initial investment plan, unless the taxpayer is carrying on an investment business

Other investment expenses

If the taxpayer takes an active role in managing their investments, they may also be able to claim a portion of other costs. Such costs should

be claimed at either Item D7 or Item D8 depending on whether they relate to interest or dividends and could include:

• travel expenses

• costs of specialist investment journals or subscriptions

• decline in value of a computer (depreciation) and computer repairs

• specialised software

• the cost of internet access (% of use for investment purposes)

• seminars

• telephone calls

• stationery / postage

• subscriptions

• post office and safety deposit boxes

• shareholders’ meetings – attendance costs

REMEMBER

A deduction can only be claimed if the investment produces assessable income (or it is reasonable to expect that it will do so).

REFERENCE POINT

Further details on Interest and Dividend deductions can be found on the ATO website by clicking here.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

63

LISTED INVESTMENT COMPANY (LIC) DEDUCTION

A deduction of 50% of the listed investment company (LIC) capital gain amount is allowed for Australian resident individuals who receive a

dividend from a Listed Investment Company and the dividend included a LIC capital gain amount.

A listed investment company is a publicly traded investment company that invests in a diversified portfolio of assets such as shares, bonds,

property and other securities.

The amount LIC capital gain amount will be shown on the dividend statement.

Example

Pansy, an Australian resident, is a shareholder in ABC Ltd, a Listed Investment Company. During the income year, Pansy received a fully

franked dividend from ABC Ltd of $70, with an eligible capital gain amount (attributable part) of $50. Pansy includes the following in her tax

return:

Item 11T Franked dividend $70

Item 11U Franking credit $30

Item D8 LIC deduction (50%) $25

ITEM D9 – GIFTS OR DONATIONS (DIV 30)

Voluntary gifts of $2 or more to an approved institution or group can be claimed as a deduction if made by the taxpayer in the year of

income and the gift is either:

• money,

• property other than money (including shares and rights), which was either purchased by the taxpayer within 12 months immediately

preceding the making of the gift or valued by the Commissioner at more than $5,000,

• publicly listed shares (on an Australian stock exchange) that have been held for at least 12 months and that are valued at $5,000 or less

(there will be CGT implications),

• trading stock, or

• made under the Heritage and Cultural programs.

Where property purchased by the taxpayer within the 12 months preceding the gift is donated, the value of the donation is the lesser of the

market value on the day it is gifted or the amount the donor paid for the property.

The ATO maintains lists of approved organisations that have been endorsed as Deductible Gift Recipients (DGR) or listed by name in tax law.

Substantiation

The receipt required for substantiation must show the name and ABN of the DGR and note that the receipt is for a gift. Donations to eligible

organisations through an employer’s payroll system (workplace giving) are allowable deductions. The Income Statement or Payment Summary from the employer, showing the amount, is sufficient evidence to support a claim for such a deduction. Where a donation is made under a salary sacrifice arrangement, the amount will not be shown on the Income Statement and no deduction can be claimed.

If the donation is made over the internet or the phone, the internet receipt or credit card statement is sufficient substantiation. For donations

made through third parties, such as banks and retail outlets, the receipt from them is sufficient.

Donations of $2 or more to bucket collections conducted by a Deductible Gift Recipient can be claimed up to a total of $10 without a receipt.

Where donations are made in joint names, the taxpayer can only claim their share.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

65

DONATIONS TO POLITICAL PARTIES

For individual taxpayers, membership subscriptions to political parties are considered contributions and are tax deductible. A deduction is

allowed for contributions or gifts to registered political parties, independent members of parliament (State or Commonwealth) or

independent candidates in an election for parliament. Contributions must be $2 or more and can be of money or property (as above). The

maximum amount that can be claimed is:

• $1,500 for contributions and gifts to political parties and

• $1,500 for contributions and gifts to independent candidates and members

A tax deduction is no longer allowed to businesses that donate to political parties.

SCHOOL BUILDING FUNDS & CHURCHES

Some school building funds are eligible deductible gift recipients. If the school has an approved school building fund that accepts voluntary

donations, such donations would be deductible. If the payment is a compulsory payment to the school building fund it is not regarded as a

donation.

Some churches arrange for a percentage of their member’s contributions to be allocated for a specific tax-deductible purpose (e.g. school

building fund, registered charity). The relevant percentage will be notified to the taxpayer in writing.

NON-DEDUCTIBLE AMOUNTS

Generally, you cannot claim a deduction for a donation if you received something in return other than token items such as lapel pins and

stickers that promote the organisation. This restriction does not apply to certain fundraising events. Thus, the purchase of an item from a

charity (e.g. pens or buying a raffle ticket) does not qualify as a donation because an item of goods or the opportunity of a prize has been

purchased. However, pens, diaries etc. may qualify as a work-related deduction at Item D5.

Membership subscriptions to charitable organisations are not deductible (e.g. Greenpeace membership).

A gift of services is not deductible under Div 30. Expenditure incurred by a taxpayer in undertaking unpaid work for a charitable organisation

is not deductible as a gift.

A deduction for a donation cannot give rise to a tax loss. However, a donation of money ($2 or more) or property (valued at over $5,000) to a

DGR may be spread over 5 years. The amount claimed each year does not have to be the same. An election must be made prior to lodging

the tax return in the year the donation is made setting out the amount to be claimed each year. More information about making an election

can be found on the ATO website by clicking here.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

66

REFERENCE POINT

A deductible gift recipient (DGR) is an entity or fund that can receive tax-deductible gifts.A comprehensive list of approved donees can be

found here:

http://abr.business.gov.au/DgrListing.aspx

FUNDRAISING CONTRIBUTIONS WITH ASSOCIATED MINOR BENEFITS

If a taxpayer contributes to a fundraising event that gives them a minor benefit, they may be eligible to claim a tax deduction. As they get a

benefit, they have not made a gift; however, they may claim a portion of their contributions as a tax deduction if the contribution meets certain conditions.

If the contribution is made to a political party, no deduction will be allowable as fundraising events held by political parties are ineligible for

this concession.

To be tax deductible, the contribution must:

• be made by an individual

• be made to a deductible gift recipient

• be for an eligible fundraising event, which is a DGR fundraising event conducted in Australia, including:

o fetes, balls, gala shows, dinners, performances and similar events

o events involving sales of goods if selling these goods is not a normal part of the supplier’s business

o events that the ATO have approved as a fundraising event

• comply with any extra conditions that apply to some DGRs

• be any of the following

o money over $150 (if the eligible event is a fundraising auction, contributors can only claim a deduction for contributions of

money)

o property purchased during the 12 months before making the contribution and valued at more than $150

o property valued by the Commissioner at more than $5,000

o shares acquired at least 12 months before making the contribution and valued at $5,000 or less but more than $150 that meet

all the following conditions

‐ contributed shares must be in a listed public company and be listed for quotation on an Australian stock exchange

‐ the contribution must be made on or after 1 July 2007

• have an associated benefit that is not more than $150 and not more than 20% of the value of the contribution.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

67

An individual attending a fundraising event may claim a maximum of two contributions in relation to attending the same fundraising event –

for example, the purchase of a ticket for the individual and one for the individual’s partner or associate. There is no limit to the number of deductions that may be claimed for the purchase of goods and services by way of successful bids at a fundraising auction.

The DGR is responsible for advising if any part of the contribution will be tax deductible.

To be eligible for the concession, the DGR cannot conduct the same type of event more than 15 times in a financial year.

Example 1 – Eligible market value

Jess pays $260 to attend a charity golf game hosted by a DGR. The market value of an 18-hole golf game is $20. The DGR works out that

Jess will be eligible to claim a tax deductible contribution of $240 ($260 − $20) as the minor benefit received (market value of the game) is

not more than $150 and not more than 20% of the value of her contribution ($52).

Example 2 – Market value too high

Bernie buys a ticket for $400 to a gala performance organised by a DGR. The gala performance has a ticket price on the open market of

$100. Even though the value of the contribution is more than $150, Bernie cannot claim any deduction as the market value of the performance – which is the minor benefit he receives in return for his contribution of $400 – is more than 20% of the value of his contribution

($80).

Example 3 – Different types of deductible contributions

Rebecca pays $260 to attend a charity auction conducted by a DGR. The ticket to the auction has a market value of $20. At the auction, Rebecca successfully bids $2,000 for a chair with a market value of $90. She also bids $1,000 for a painting with a market value of $100. Rebecca can claim three separate deductions – one of $240 for her contribution for the right to attend the auction, one of $1,910 for the purchase of the chair at auction, and a further $900 for the purchase of the painting.

CROWDFUNDING

Crowdfunding is the practice of using the internet and/or social media to find supporters and raise funds for a project or venture.

In donation-based crowdfunding, a funder makes a payment (or ‘donation’) to the project or venture, without receiving anything in return. The

funder’s contribution may simply be acknowledged – for example, on the crowdfunding website.

The ‘donation’ made to the crowdfunding is NOT deductible unless the project or venture has been endorsed as a deductible gift recipient

(DGR) by the ATO.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

68

ITEM D10 – COST 0F MANAGING TAX AFFAIRS

Expenses incurred in managing the taxpayer’s tax affairs and complying with an obligation imposed by a Commonwealth law in relation to

income tax affairs are deductible under s 25-5 of the ITAA 1997. Fees and commissions paid for professional advice on income tax matters

are only deductible if the advice is provided by a recognised tax advisor i.e.:

• tax agent or BAS agent registered with the Tax Practitioners Board

• tax (financial) advisor

• enrolled legal practitioner

Fees paid to tax advisors are deductible when they are incurred. Fees for the preparation of tax returns for an individual and associated

person (such as a spouse) need to be apportioned if there is a single invoice for these costs.

Phone calls, faxes and postage, as well as the cost of travel to and from the agent are also deductible. Methods used for claiming motor

vehicle expenses are discussed in a later module.

Taxpayers may also incur the following deductible expenses in the preparation and lodgement of their income tax return and activity

statements:

• buying tax reference material

• tax return preparation courses

• lodging a tax return through a registered tax agent

• obtaining tax advice from a recognised tax adviser

• dealing with the ATO regarding their tax affairs

• purchasing software to allow the completion and lodgement of their tax return. If the software is used for other purposes, the cost must

be apportioned

Other claimable expenses

Penalty Interest – A deduction is allowable for interest charged by the ATO for late lodgement of tax (in the year in which it was paid). This

interest will be shown on the taxpayer’s prior year tax assessment notice.

General Interest Charge that continues to accrue on unpaid tax bills is deductible in the income year in which it is imposed.

Quantity surveyor’s report detailing capital expenditure incurred on eligible capital works in accordance with Division 43 for a rental property

is claimed here and not against rental income.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

69

Obtaining a valuation for a deductible gift or donation of property.

Appeal costs – A deduction is allowable for the costs of appealing or objecting to an assessment notice or tax determination, including court

and tribunal fees as well as solicitor, barrister and other legal costs.

The cost of managing tax affairs is separated and claimed as follows at Item D10:

Label N Interest charged by the ATO

Label L Litigation costs

Label M Other expenses

ITEM D12 – PERSONAL SUPERANNUATION CONTRIBUTIONS DEDUCTION

A taxpayer may be able to claim a tax deduction for personal superannuation contributions. There are certain eligibility requirements that

need to be met.

Personal superannuation contributions are amounts that a taxpayer has paid from after-tax income to an eligible complying superannuation

fund or retirement savings account (RSA) to provide superannuation benefits for themselves, or for their dependants in the event of their

death. No deduction can be claimed for salary-sacrificed contributions.

Most superannuation funds are eligible complying superannuation funds, but this should be checked if a deduction is to be claimed by the

taxpayer.

Any deduction claimed can only reduce the taxpayer’s taxable income to nil. It cannot add to or create a tax loss.

Before a deduction can be claimed for personal superannuation contributions, the taxpayer must have notified their superannuation fund

or RSA of their intent to do so. This notice must have been given to the superannuation fund or RSA on or before the day the tax return is

lodged for the relevant year or by the 30 June in the following year, whichever is earlier.

The notice must be done in an approved form (e.g. Notice of intent to claim or vary a deduction for superannuation contributions) and the

taxpayer must receive an acknowledgement from the fund before the deduction can be claimed in the tax return.

The following additional conditions must be satisfied:

• age-related conditions

• the fund must not be a

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

70

o Commonwealth public sector superannuation scheme with a defined benefit interest

o constitutionally protected fund or other untaxed fund that would not include the contributions in their assessable income or

o a super fund that notified the Commissioner before the start of the income year that they elected to treat all member

contributions to the

‐ super fund as non-deductible

‐ defined benefit interest within the fund as non-deductible

• at the time the notice was given, the superannuation fund or RSA provider still held the contributions in respect of which the notice was

given (this requirement may not be met if, for example, the contributions were rolled over to another super fund before giving the notice)

• the contributions were not attributable to certain super housing measures or capital gains for which a retirement exemption applied.

Age Related Conditions

• Aged 75 years old or older – a deduction can only be claimed for contributions made before the 28th day of the month following the

month in which the taxpayer turned 75. The taxpayer must satisfy the work test.

• Under 18 years old at the end of the year – a deduction can only be claimed if the taxpayer earned income as an employee or a business

operator during the year.

• Aged 67 – 74 years of age at the time the contribution was made – the taxpayer must satisfy the work test or meet the work test

exemption criteria to be able to claim a tax deduction for personal super contributions.

From 1 July 2022, a super fund is able to accept non-concessional contributions or salary sacrifice contributions made by or on behalf of a

member aged 67 – 74 even if they do not satisfy the work test. However, to be able to claim a tax deduction for super contributions a member aged 67 – 74 must satisfy the work test.

Work Test

To satisfy the work test, the taxpayer must have worked at least 40 hours during a consecutive 30-day period in the financial year for the superannuation fund to accept the contributions for which they intend to claim a deduction.

The work test exemption applies from 1 July 2019. To meet the work test exemption criteria, the taxpayer must have:

• Satisfied the work test in the financial year preceding the year in which the contributions were made

• Have a total superannuation balance of less than $300,000 at the end of the previous financial year, and

• Not previously used the work test exemption.

Tax is paid by the super fund on concessional contributions (at a rate of 15%). High income earners may be liable for an additional 15% tax

on these contributions.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

71

Example

Timothy is a full-time administration assistant. During the year, he earned $70,000 before tax and his employer paid $7,000 in super guarantee payments on his behalf. Timothy has no other income. Timothy makes a personal contribution of $3,500 to an eligible superfund and notifies them that he intends to claim a deduction.

Timothy’s superfund acknowledges that he will claim a $3,500 deduction and taxes the contribution at 15% ($525). Timothy claims a deduction for $3,500 in his Income tax return. As Timothy’s marginal tax rate (including Medicare) is 34.5%, his income tax will be reduced by

$1,207.50 as a result of the deduction.

WARNING

In order to claim a deduction for personal superannuation contributions the superannuation fund must have received the contributions by

the end of the income year. Contributions received after the end of the income year can only be claimed as a deduction in the following year,

even if steps were taken (such as posting a cheque or initiating a direct debit) prior to the end of the year.

Where a taxpayer may be entitled to a superannuation co-contribution, the benefit of claiming a tax deduction for the superannuation contributions should be compared with any potential benefit from the co-contribution. The co-contribution is only available for low-income earners

who make personal superannuation contributions up to $1,000 and who do not claim a tax deduction for them (covered in a later module).

To complete Item D12, the following information will need to be provided:

• Full name of fund

• Account number

• Fund ABN or TFN

There is also a tick box to confirm that a notice of intent to claim a tax deduction was provided to the superannuation fund and that an acknowledgement has been received.

The deduction claimed may also be used in the income tests for eligibility for certain tax offsets and government benefits

CONCESSIONAL SUPERANNUATION CONTRIBUTIONS CAP

For most employees, there is a limit (cap) to the amount of concessional contributions able to be made to superannuation funds during the

year. If the cap is exceeded, additional tax may be payable. For the 2022, 2023 and 2024 years, this cap is $27,500. Concessional contributions include super guarantee contributions, salary sacrifice contributions and contributions for which the taxpayer has claimed a tax deduction.

From the 2019-20 year onwards, a person with a total superannuation balance (TSB) of less than $500,000 on 30 June the previous financial

year may be entitled to contribute more than the concessional contributions cap by making additional concessional contributions for any

unused concessional cap amounts from previous years. Unused concessional cap amounts from the 2018-2019 year onwards can be carried forward for these purposes and are available for a maximum of 5 years. The amounts carried forward will expire if they remain unused

after 5 years.

The TSB on 30 June of the year prior to the year the catch-up opportunity is actually used is the only superannuation balanced that is relevant. This means that someone with more than $500,000 on 30 June before one financial year could have their TSB fall below $500,000 on

30 June in a subsequent year, making them eligible to make catchup concessional contributions in that subsequent year.

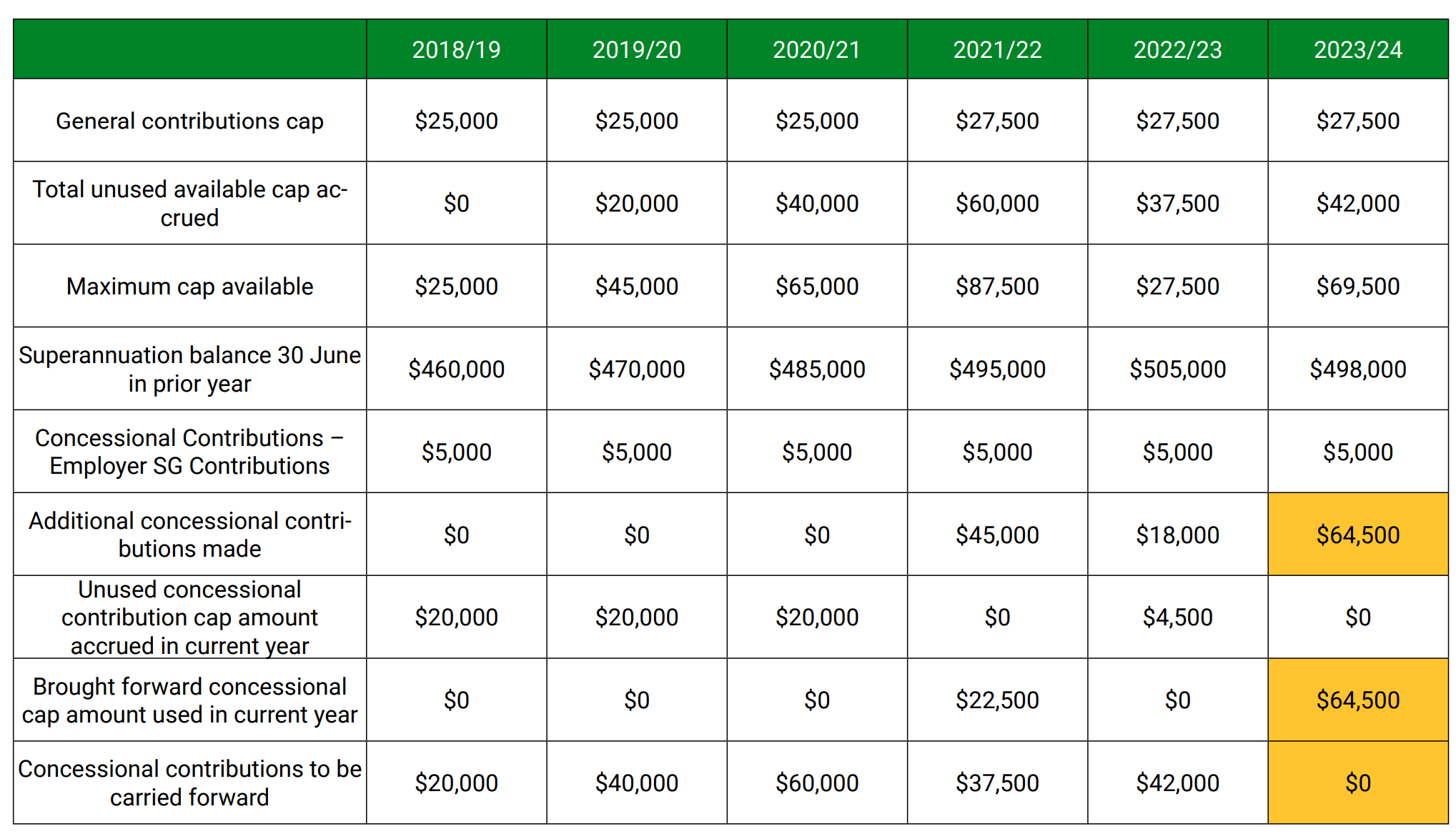

Example

Lydia’s employer makes SG contributions on her behalf of $5,000 each year. In addition, Lydia made additional superannuation contributions

in the 2022 and 2023 years of $45,000 and $18,000 respectively, for which she claimed a tax deduction. Lydia had not made personal superannuation contributions prior to the 2022 year.

Lydia would like to make additional superannuation contributions in the 2024 year. What is the maximum amount of superannuation contributions for which Lydia can claim a tax deduction in the 2024 year?

Lydia’s superannuation contributions and TSB for the years 2019 – 2024 are shown below

The concessional contributions cap for the 2023-24 year is $27,500. However, as Lydia has a TSB of less than $500,000 at the end of the

2023 year, she is able to increase her concessional contributions cap for the 2023-24 year using the carry forward provisions. The unused

available cap accrued as 30 June 2023 is $42,000. Lydia’s concessional cap for the 2024 year is increased to $69,500. As her employer has

made $5,000 concessional contributions on her behalf, she can make additional concessional contributions of $64,500

ITEM D15 – OTHER DEDUCTIONS

Sickness and accident / income protection insurance A deduction can be claimed for a premium paid for insurance against

the loss of income. To be deductible, the benefits afforded by the

policy must provide the taxpayer with assessable income during a peri

–

od of incapacity, i.e. they comprise payments that are income in nature.

Where the benefit under the policy takes the form solely of

a

(capital) lump sum payment for say, loss of

a limb or death, no part of

the premium will be deductible. This means that premiums for life in

–

surance and trauma policies are not deductible.

Where the insurance policy is taken out through a superannuation fund

and the premiums are deducted from the superannuation

contributions no deduction is allowable.

If the policy is a combined policy, and may provide both income and

capital benefits,

a breakdown of the premiums that relate to the

income benefits will be required.

Usually the taxpayer will receive a letter from the company detailing the

Policy Number and amount to claim.

Other deductible amounts that should be claimed at D15 are

discussed elsewhere in this course as required.

ITEM 14 & ITEM P1 – PERSONAL SERVICES INCOME

(PSI)

Personal Services Income is income that is mainly a reward for an individual’s

personal efforts or skills. This will be covered in detail later in the course but is

mentioned here as Personal Services Income also includes payments made to an

individual under a labour-hire agreement. The PAYG payment summary that is

issued for these payments looks very similar to the PAYG Payment Summary –

individual non-business form.

An example of the PAYG Payment Summary – business and personal services

income form is shown below.

Labour hire is the term applied to the provision of outsourced skilled and unskilled

workers hired for short or long-term positions.

The workers, known as contractors, field employees, temps, on-hired employees

or even just employees, are employed by the labour hire organisation. They are not

employed by the company to whom they provide labour. Their income is payable

under a contract which is wholly or principally for the labour or services of a

person.

Under this type of arrangement:

• the labour hire firm arranges for workers to perform work or services directly

for clients

• the client pays the firm for this service

• the firm pays the worker for work performed or services provided to the client

• the worker is not an employee of the client

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

77

Care must be taken when entering the information from this PAYG Payment Summary into the tax return that the details are entered at the

correct item number.

The income received by the worker and shown on the payment

summary is entered at two sections of the tax return, Item P1 and Item

14 (NOT Item 1). It is important that the income be reported at Item P1

and Item 14, as there are some differences in deductions that can be

claimed against labour hire income as opposed to ordinary

employment income.

At Item P1, there are questions that are required to be answered. In the

case of income from labour hire, they will generally be answered as

follows:

The gross income is entered in Part B – label O. Any deductions against

this income are entered at labels K and L. The net figure at label A is

transferred to Item 14 of the tax return, which is where any tax withheld from the income is recorded.

A description of the main business activity as well as the Business Industry Code (BIC) must be entered at Item P2, and the number of

business activities at Item P3. When using the software, there is a

search faciltiy available to find BIC. In some cases it may be easier to

use the BIC Tool available on the ATO Website.

Section 01

Section 02

Section 03

Section 04

Section 05

Section 06

78

PERSONAL SERVICES INCOME DEDUCTIONS

Taxpayers receiving labour hire income can claim most of the same type of expenses as an employee against their income provided they

are incurred in order to earn that income, however they will not be able to claim a deduction for occupancy expenses, even if they do satisfy

the necessary criteria. This will be discussed further in detail in a later module.

Pay careful attention to any additional information provided with the PAYG Payment Summary as often there have been

deductions made for insurance that the taxpayer can claim as an expense.

If superannuation has been deducted from the labour hire income and paid in on the taxpayer’s behalf they would be

eligible to claim a deduction for this provided they inform their superannuation fund they intend to claim a deduction by the due date and receive the letter from their fund acknowledging this.

REMEMBER

Expenses incurred earning labour hire income are NOT claimed at items D1 to D5 of the tax return. The total expenses claimed against the

PSI will be included at Item P1 Labels K and L.